Procrastination is a mysterious force that keeps many of us from completing the most important tasks in our lives. Often, we put off something we deem important simply because we believe it may not necessarily be urgent.

We know it is important to save for our future, but we typically underestimate the damaging effect of delaying this task. Most fail to realize the tremendous power of time and the impact it has on our ability to create wealth. We simply do not understand what’s at stake.

Ironically, for many, by the time they realize the power of time, it’s far too late in life to have meaningful impact on their financial well-being.

“Most people overestimate what they can do in a year and they underestimate what they can do in two or three decades.” – Tony Robbins

The Power of Compounding

Compound interest or, more generically, a compound rate of return allows you to make money using the money you just made. This is illustrated in the following example.

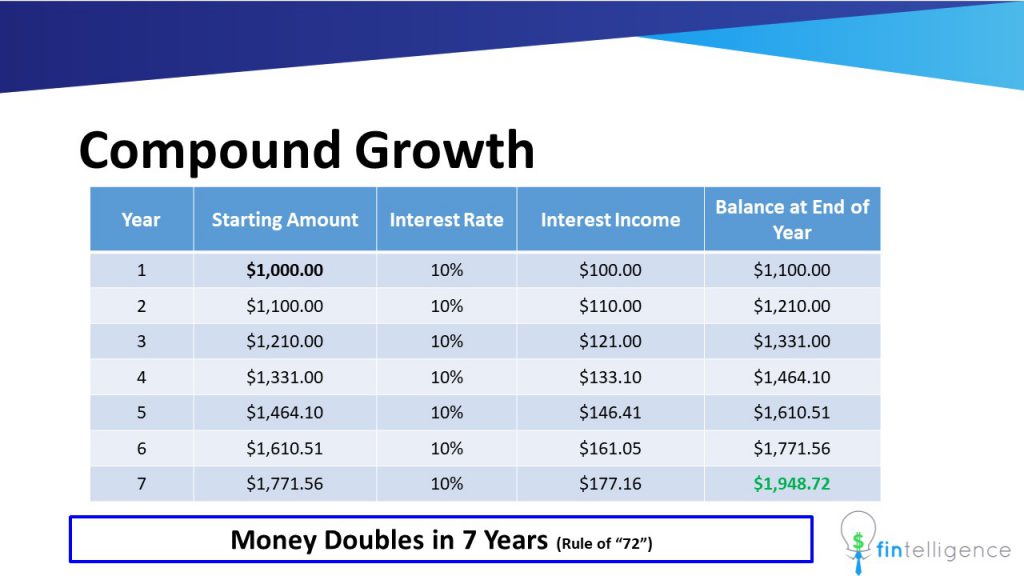

Assume you invest $1,000 and earn a 10% annual rate of return on your investment. Simple math would tell you that you’d expect to earn $100 on your investment at the end of the first year (10% of $1,000 = $100). At the beginning of the second year, your investment would be worth $1,100 ($1,000 initial investment plus $100 interest you earned in year one). This amount will earn you an additional $110 at the end of the second year (10% of $1,100 = $110). The table below shows the interest earned in subsequent years.

Note in the above that with a 10% compound rate of return, an investment doubles in a little bit over 7 years.

The “Rule of 72”

Referring to our example, the “Rule of 72” estimates it would take 7.2 years for an investment to double at an annual compound rate of return of 10% (72/10 = 7.2). In reality, it takes about 7.3 years to double.

The Value of $1 a Day

Starting Late

- Invest $50,000 and end up with $1,100,000; or

- Invest $125,000 and end up with $570,000?

Recent Comments